|

|

8 Sep 2009

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: Whangarei, NZ

Posts: 2,214

|

|

|

Yes, that's the Malaysian AA. Try emailing erly [at] aam.org.my . The Swiss Touring Club also does carnets for non-residents, you need to use the search on HUBB to find the details. And yes, do ask Paul Gowen.

Cheers,

Peter.

|

21 Oct 2009

|

|

Registered Users

New on the HUBB

|

|

Join Date: Oct 2007

Location: Darwin Australia

Posts: 4

|

|

Check with Customs, you can do a temporay import into Australia by paying a security deposit.

Securities

Securities can also be used for the temporary import of goods. A Customs Officer with the appropriate delegation will decide if the intended use and ownership of the goods satisfies the temporary import requirements. The security may be in the form of cash or a bank guarantee. In some circumstances Customs may accept an undertaking from a suitable client. The security is an amount equal to the duty and taxes that would have been payable at import.

Goods that may be imported under security include any goods that may be accepted under carnet, plus goods owned by tourists or temporary residents, or goods that are coming to Australia to be tested and evaluated or to be used in testing and evaluation.

To import goods using a security you apply using a  Form 46 Form 46 (for goods under Section 162) or  Form 46aa Form 46aa (for goods under Section 162A).

Another provision for the temporary import of goods exists for goods that are brought into Australia for repair or alteration, not including industrial processing. This is covered by Schedule Four of the Customs Tariff Act 1995 (by-law 9640055) and goods are entered under a Section 42 security.

For entry under any of these types of securities, copies of normal commercial import documents such as invoices, packing lists, bills of lading or air waybills, quarantine certificates and other documents that verify eligibility should be lodged with the application. Any permits that would normally be required for these goods must also be obtained. If your goods qualify and if an acceptable security or undertaking has been given to Customs we will grant permission for the goods to be delivered. You will also need to lodge a Customs declaration for the goods.

|

21 Oct 2009

|

|

Contributing Member

Veteran HUBBer

|

|

Join Date: Sep 2003

Location: Whangarei, NZ

Posts: 2,214

|

|

|

Goods, yes. Vehicles are specifically mentioned as needing a CdP.

|

3 Dec 2009

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Dec 2007

Location: Singapore

Posts: 157

|

|

|

hi all, we managed to ship our bike from LA to sydney.

getting the bike out of usa is a pain in the S.

with a carnet, the whole procedure is SO EASY!

without a carnet, we think it might be possible to import the bike but by filling in all the forms will make u surrender and thoughts of burning the bike comes after that!

I might be possible to import the bike without carnet... might be...

if anyone knows this, please feed...

thanks!

goh...happy now

|

17 Dec 2009

|

|

Contributing Member

HUBB regular

|

|

Join Date: Sep 2005

Location: Home in Tasmania for the summer

Posts: 53

|

|

|

Coming back to Oz

Quote:

Originally Posted by RogerM

The law was amended late last year and came into effect (I think May 2009) requiring carnets for tourist's vehicles - the carnet exempts vehicles from having to get Australian Design Rule compliance, whereas the vehicle import approval scheme required ADR compliance. Its now a legislated requirement and there are no exemptions allowed.

I might add that the same legislation now requires Australian owned vehicles going out of Australia to get a carnet before Customs will allow it back into Australia. They have gone mad in Canberra!!

|

Well, no, it's not quite like that .....

I've just brought my Tassie reg'd bike back in from the States, arrived 27 November. Had to apply to import it!!! Yaarrrrk! After myriads of phone calls, eventually got to speak with someone in Canberra who understood logic (and the utter stupidity of what the bureauratic bunglers wanted me to do), and who then assisted me greatly and expeditiously.

I needed a photo of the ADR/compliance plate (the bike was still in the Qantas (Brisbane) warehouse, but Qantas staff were fabulous, and took the photo for me!!), ID docs, copies of the current and previous registration papers, the waybill from the outbound flight (to prove it had left Oz originally) and the multi-page Vehicle Import Application form. Instead of the usual **17** days, he authorised it's entry in just ONE day! But then he posted the approval letter to my home in Tassie - I was in Brisbane!! Oops! But he did a certified copy and sent it to me in Brisbane.

But, overall, had I known about these new rules that came in in March 2009, I could have done all the paperwork over the internet and had everything ready and waiting for when I arrived. BTW, for Australians returning home, there is absolutely NO NEED to use an [ripoff  ] agent! It is easy enough to do yourself, and the Customs staff will usually help, if you need help with anything.

|

5 Jan 2010

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: May 2007

Location: Houston, USA

Posts: 164

|

|

|

Hey Goh!

Your favorite texan here... Hope all is well in ya'lls travels.

What did you end up doing with temporarily importing your motorcycle?

|

4 Feb 2010

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Dec 2007

Location: Singapore

Posts: 157

|

|

Quote:

Originally Posted by daveg

|

Hi

Dave... Miss that Lone Star bock in that old lady's pub. izit snowing over there?

yes, we got our Carnet being sent to San Francisco. it's hell lots of stupid work.

what;s your route and time for RTW?

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

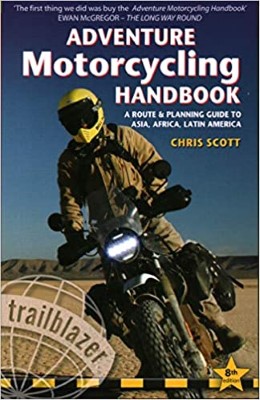

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|