|

2 Jan 2008

|

|

Registered Users

HUBB regular

|

|

Join Date: Dec 2006

Location: UK

Posts: 64

|

|

|

Approx customs charges for import to UK

Hi All,

Can anyone offer any advise on what I should expect to pay the Uk customs and immigration when my bike arrives back in the UK, as it is on USA plates, and i intend to keep it there

The bike is in the conditon you would expect after 27,000 miles so I was hoping they wont sting me for too much.

All adivse is welcome, also if anyones knows how tricky it is leaving the Grimaldi boat at Tilbury I would be very interested in how they found it.

thanks

Simon

Global Enduro

|

2 Jan 2008

|

|

Registered Users

Veteran HUBBer

|

|

Join Date: Jun 2007

Location: Ripley, Derbyshire

Posts: 373

|

|

|

Hi, Simon,

Congrats on reaching the end of your journey, I've been a big fan of your site.

Right import costs depend on how far over you can bend while grabbing your ankles, while shouting please sir can I have another.

No really all you have to do if FAKE up an invoice for a cheap price, stating that you recently paid for the bike with 27k on the clock. Then use that for when you import the bike, remember that you will also have to pay to register the bike in the UK.

I know the bikes now a member of your family and is a faithful friend, but balance that against how much shipping, import tax and re-registration is going to cost, so is it cheaper to sell the bike while still overthere?

Lee

|

3 Jan 2008

|

|

Registered Users

HUBB regular

|

|

Join Date: Dec 2006

Location: UK

Posts: 64

|

|

|

bike

Thanks Lee,

Yeh I have weighed up the pros and cons of selling or not, and after deciding that I need a bike for work when I get home I have decided its pointless selling it, what with the fact its only been about 4500 miles since it had new piston etc.

But Ill try get a bill of sale sorted out, thats a good idea. Thnaks for the advise-

Simon

|

3 Jan 2008

|

|

Registered Users

HUBB regular

|

|

Join Date: Dec 2006

Location: UK

Posts: 64

|

|

|

can someone confirm my thoughts?

So Lee, or somebody else,

I have done some research and this is what I think I have discovered. Can someone confirm if this is right or not.

Basically if I bought the bike over 6 months ago abroad, and if I intend not to sell it (which I do not) then I understand that this intitles you to enter the UK without havving to pay VAT, and maybe even the import duty of 6%.

However below is the extract I get this from, and I dont seem to qualify for parts 1 and 2, even though I cant see what difference it would make, having said that the extract is not totally relivant to me as I am not trying to move to the UK, I live there anyway!

If someone can confirm this or correct me I would be very grateful.

Simon

5.1 Can I get relief from duty and tax on transfer of residence?

Yes. You can bring in your belongings or vehicle free of duty and tax so long as you:- are moving your normal home to the EC

- have had your normal home outside the EC for a continuous period of at least 12 months

- have possessed and used them for at least 6 months outside the EC before they are imported

- did not get them under a duty/tax free scheme (but see paragraph 5.2)

- declare them to us as explained in paragraph 3.2

- will keep them for your personal use and

- do not sell, lend, hire out or otherwise dispose of them in the EC within 12 months of importation, unless you notify us first and pay duty and VAT on disposal. Our National Advice Service can tell you how to do this.

Belongings include clothing, furniture, portable tools of trade, pets and other household and personal effects, but not alcoholic drinks or tobacco products: you will not get relief on those unless they travel in with you and qualify for the duty-free allowances - see paragraph 2.1.

We will normally waive the second and third conditions if you could not meet them due to circumstances beyond your control. Explain the position to our officer when you declare your belongings or vehicle.

Generally speaking, "possession" means "to have" rather than "to own", but there are particular restrictions in relation to company vehicles imported by travelling sales representatives. Our National Advice Service can give you full details.

See paragraph 5.5 if any of your belongings or vehicle were previously taken out of the EC.

Other goods and vehicles imported for commercial purposes will not qualify for this particular relief. However, if you are also transferring your business to the UK, you may be able to claim the alternative relief on imported capital goods. See our Notice 343 Importing capital goods free of duty and VAT.

Last edited by S-Mendus; 3 Jan 2008 at 18:58.

|

3 Jan 2008

|

|

Gold Member

Veteran HUBBer

|

|

Join Date: Apr 2002

Location: Abu Dhabi

Posts: 887

|

|

Quote:

Originally Posted by S-Mendus

I have done some research and this is what I think I have discovered. Can someone confirm if this is right or not.

|

Simon

That seems to match what I have found out. Below are the notes a friend sent me regarding the import to the UK of his Dubai-registered bike. Some of it may not be appropriate for your case:

"To avoid VAT and import duty you need to have owned the bike more than six months and be returning to live in the UK. Phone the DVLA on 0870 2400010 for confirmation and they will also send the appropriate forms.

You need to complete a V55/5, have valid insurance, have paid £25 road registration, have a log book (?) and dated evidence (receipt) showing purchase. You also need to take it to the Goods Vehicles testing department (0870 6060440) who will issue a certificate saying the bike conforms to EU standards. To get this you'll have to flick the lights over (built in on his BMW) and change the speedo to miles.

When you have all the documents and paper work completed, insure with someone like Carole Nash and send off all the paperwork showing insurance, and wait 3 weeks to get your new plate.

I guess the only question is how to avoid the duty. I filled out a transfer of residence document and didn't pay any."

Hope that helps a little.

Stephan

|

|

Currently Active Users Viewing This Thread: 1 (0 Registered Users and/or Members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

Check the RAW segments; Grant, your HU host is on every month!

Episodes below to listen to while you, err, pretend to do something or other...

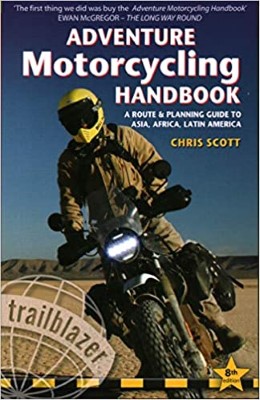

2020 Edition of Chris Scott's Adventure Motorcycling Handbook.

"Ultimate global guide for red-blooded bikers planning overseas exploration. Covers choice & preparation of best bike, shipping overseas, baggage design, riding techniques, travel health, visas, documentation, safety and useful addresses." Recommended. (Grant)

Led by special operations veterans, Stanford Medicine affiliated physicians, paramedics and other travel experts, Ripcord is perfect for adventure seekers, climbers, skiers, sports enthusiasts, hunters, international travelers, humanitarian efforts, expeditions and more.

Ripcord Rescue Travel Insurance™ combines into a single integrated program the best evacuation and rescue with the premier travel insurance coverages designed for adventurers and travel is covered on motorcycles of all sizes.

(ONLY US RESIDENTS and currently has a limit of 60 days.)

Ripcord Evacuation Insurance is available for ALL nationalities.

What others say about HU...

"This site is the BIBLE for international bike travelers." Greg, Australia

"Thank you! The web site, The travels, The insight, The inspiration, Everything, just thanks." Colin, UK

"My friend and I are planning a trip from Singapore to England... We found (the HU) site invaluable as an aid to planning and have based a lot of our purchases (bikes, riding gear, etc.) on what we have learned from this site." Phil, Australia

"I for one always had an adventurous spirit, but you and Susan lit the fire for my trip and I'll be forever grateful for what you two do to inspire others to just do it." Brent, USA

"Your website is a mecca of valuable information and the (video) series is informative, entertaining, and inspiring!" Jennifer, Canada

"Your worldwide organisation and events are the Go To places to for all serious touring and aspiring touring bikers." Trevor, South Africa

"This is the answer to all my questions." Haydn, Australia

"Keep going the excellent work you are doing for Horizons Unlimited - I love it!" Thomas, Germany

Lots more comments here!

Every book a diary

Every chapter a day

Every day a journey

Refreshingly honest and compelling tales: the hights and lows of a life on the road. Solo, unsupported, budget journeys of discovery.

Authentic, engaging and evocative travel memoirs, overland, around the world and through life.

All 8 books available from the author or as eBooks and audio books

Back Road Map Books and Backroad GPS Maps for all of Canada - a must have!

New to Horizons Unlimited?

New to motorcycle travelling? New to the HU site? Confused? Too many options? It's really very simple - just 4 easy steps!

Horizons Unlimited was founded in 1997 by Grant and Susan Johnson following their journey around the world on a BMW R80G/S.

Read more about Grant & Susan's story

Read more about Grant & Susan's story

Membership - help keep us going!

Horizons Unlimited is not a big multi-national company, just two people who love motorcycle travel and have grown what started as a hobby in 1997 into a full time job (usually 8-10 hours per day and 7 days a week) and a labour of love. To keep it going and a roof over our heads, we run events all over the world with the help of volunteers; we sell inspirational and informative DVDs; we have a few selected advertisers; and we make a small amount from memberships.

You don't have to be a Member to come to an HU meeting, access the website, or ask questions on the HUBB. What you get for your membership contribution is our sincere gratitude, good karma and knowing that you're helping to keep the motorcycle travel dream alive. Contributing Members and Gold Members do get additional features on the HUBB. Here's a list of all the Member benefits on the HUBB.

|

|

|